Shaping The Future of Customer-First Strategies

Transformative Ideas.

Exclusive Content.

Invite Only.

Digital Insurance Connect 2024

August 26 - 28, 2024

Rancho Bernardo Inn, San Diego CA

Exceed the Expectations Of Your Customer

Learn how. Reserve your spot now.

Starting Tomorrow’s Digital Revolution Today.

Digital Insurance Connect provides you with an opportunity to network and benchmark with like-minded peers while collaboratively problem-solving and preparing for the future.

Our mission is to gain timely perspectives on acquiring the modern insurance customer through digital strategies, retaining customers and building consistent customer loyalty through second-to-none CX, while fostering an environment of innovation in your organization through change management.

This invite-only event brings together digital marketing & CX leaders from North America’s top insurance companies, agencies, and brokers in an intimate environment to exchange ideas and timely perspectives on acquiring the modern insurance customer through digital strategies, retaining customers and building consistent customer loyalty through stellar CX and fostering an environment of innovation in your organization through change management.

Our 2024 Advisory Board Members

Scott Campbell

SVP, Chief Client Experience and Corporate Communications

American National

Don Ciccolella

Sr. Social Media & Digital Marketing Manager

Selective

Megan Lotay AVP

P&C Digital and Omnichannel Servicing

USAA

Sachin Rustagi

Head of Digital

Merkel

Jared Vestal

VP, Growth & Journey Marketing

Geico

The Highest Caliber of Content. Created Just For You

Here is a snapshot of the topics covered at this year’s event.

Never Mind The Slowdown: Increase Digital Capabilities for Enhanced Customer Experience and Business Grow

Utilizing AI to Deliver a Seamless Digital Customer Experience

The Win-Win Situation: Using Tech To Enable Stronger Digital Broker Partnerships

Maximizing Digital Transformation ROI Through Effective Digital Adoption Strategies

Designing a Functional Future; The Art of Systemic Disruption

Unlocking Growth: Exploring Embedded Insurance and Customer-Centric Strategies

The Connect Experience

Transformative Content

Hear customized content that fosters powerful conversations and benchmarking with your peers, delivered by the most prominent minds in the industry. Engage in in-depth discussions focused on your biggest pain points, benchmark and leave with innovative strategies.

Pre-Scheduled 1:1 Meetings

See someone on our attendee list you want to meet? Mutually matched and pre-scheduled 1:1 meetings with potential partners and peers make it easy to further your business. This tailored format helps you to identify long lasting, strategic solutions to transform your supply chain operations.

You’re part of a high-level invitation-only forum

You’ll participate in a curated event experience with focused, inspirational content delivered by the most influential digital innovators. In addition, enjoy outstanding accommodations with a two-night hotel stay, and all refreshment breaks and receptions are completely complimentary. Join this exclusive community of insurance leaders.

Meet Exceptional People

Build relationships and broaden your perspectives in an intimate and interactive environment designed to foster deep connections with fellow C-Suite and Senior Insurance Leaders. Participate in multiple ways to build relationships throughout this bespoke program – roundtables, townhalls, interactive workshops, themed receptions, welcome activities and much more.

Speak Freely and Openly

Openly discuss your biggest priorities and challenges with peers in an exclusive, private forum. Have honest dialogues and engage directly with your peers.

True Thought Exchange

"Digital Insurance Connect was just right … large enough to attract the top Innovation and Digital Minds in the industry but small enough for true thought exchange and intimate conversations."

Mark Rieder, Head of Innovation, NFP

High Powered Thinkers

"A buzzword-free, relevant, and practical gathering of high-powered thinkers sharing ideas, solving problems, and moving progress forward in the innovation and digital insurance space."

Rose Hall, PE, CRIS, Senior Vice President, Head of Innovation, Americas AXA XL

Interactive and Personal

"The event exceeded my expectations. The speakers to vendors and all the networking was above and beyond what I had expected. Having a smaller group really helped make it much more interactive and personal."

Eric Gnagey director of software engineering and product Nationwide

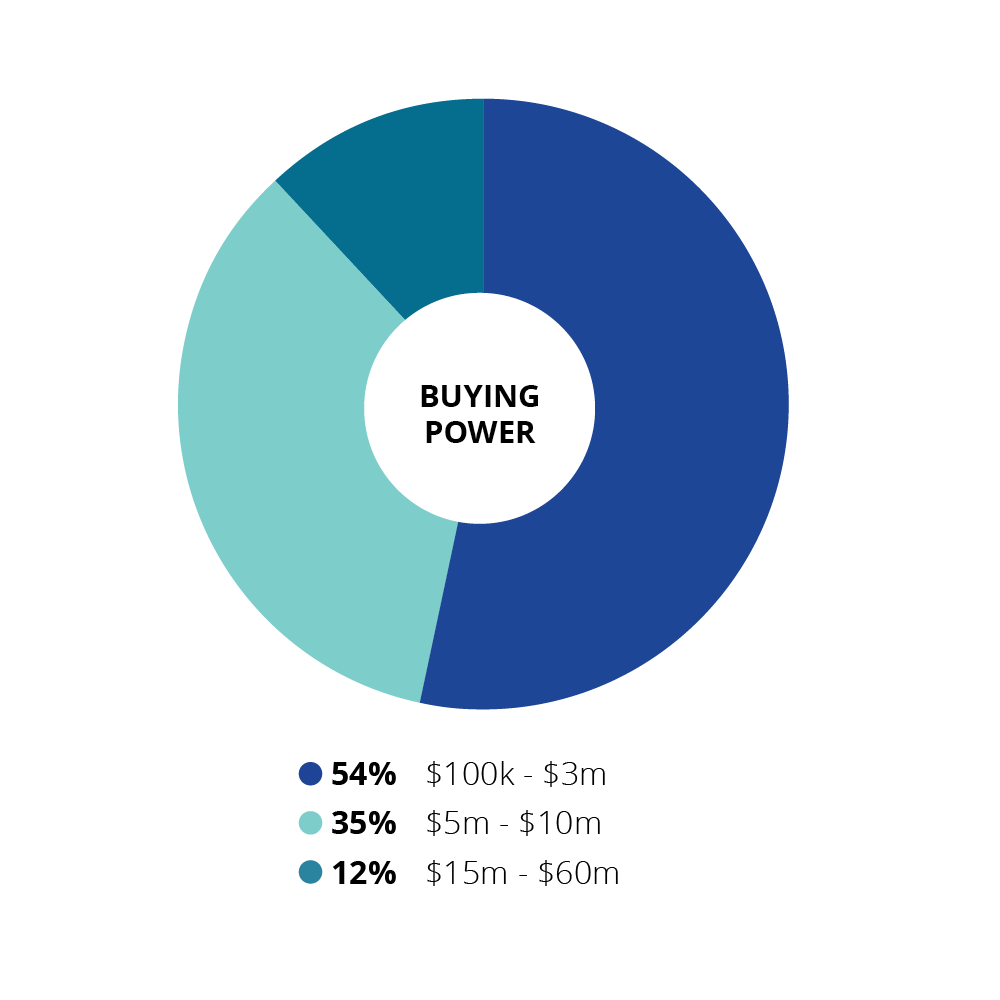

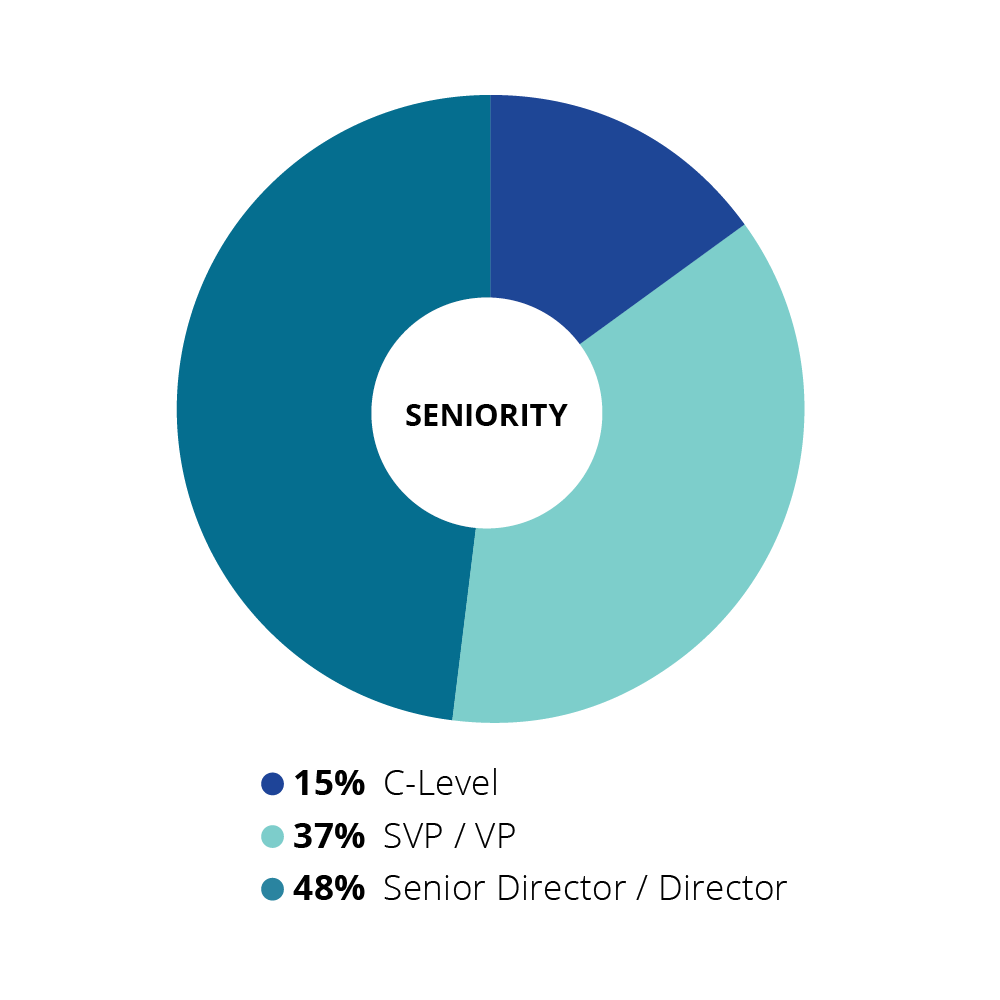

Our Audience Breakdown

Let’s Connect & Create A Custom Sponsorship Experience

Engage with decision-makers who are looking for solutions, now. All of the Digital Insurance Connect attendees are profiled and genuinely interested in learning more about solutions like yours. Find out more about how you can get involved by contacting me below.

Come as An Attendee – Leave as Part of our Digital Insurance Community