Future Branches Austin 2024

December 04 - 06, 2024

Marriott Austin Downtown, TX

The Conference for Branch & Retail Banking Innovators

Passionate About Elevating the Conversation in 2024?

Have insights on the latest trends and innovations transforming banking? We're seeking visionaries like YOU to spark and inspire at our event. Make your mark; reach out and let's amplify your voice!

Contact ElizabethTransform Your Branch Experience

While the pandemic drove digital adoption and helped banks and credit unions push the needle on innovation, the recent economic turmoil and high interest rates have driven customers back towards needing more financial advice and wanting a human connection with their bank. How is your branch handling these changes and turning them into new opportunities? Join your peers at Future Branches Austin for 3 days of immersive learning, interactive sessions and fun networking. Walk away with pages of strategies for your branch that will inspire customer trust, deposit growth and much more!

Great Takeaways

“There is no other conference out there that covers content like Future Branches. Speakers provide takeaways that I can directly apply to decisions I’m making right now about the next five to ten years.”

Leslie Spence

Assistant VP of Member Experience

Partner Colorado Credit Union

Well Organized

"Thanks for organizing such good event. I enjoyed the frank sharing and open discussion!"

Eros Ye

Head of Future Branch, Applied Innovation

HSBC

Awesome Connections

"It’s was great meeting with branch execs from all sized institutions. Getting the perspective from those with thousands of branches or just 1 or 2 created some great insights."

Michael Nalley

SVP, Director of Corporate Real Estate

BOK Financial

Past Speakers Included

Bold, Brave, Innovative – Learn from the best!

150+ Branches

Heather Kesner

SVP, Small Business & Branch Banking Regional Executive

U.S. Bank

Kaylynn Irsik

Retail Support Operations/Hiring Manager

Zions Bank

Jason Furer

Senior Vice President-Channel Distribution Strategy Leader

Wesbanco

Natalie Julich

Head of Experience Design

Arvest Bank

50 - 150 Branches

Art Stevens

President, Retail Banking

Trustmark Bank

Chuck Frederick

EVP, Chief Retail Banking Officer

Academy Bank

Josie Huelskamp

President-Retail and Digital Banking

FirstBank

Derrick Harris

Vice President, Branch Operations

PenFed Credit Union

Under 50 Branches

Kenyon Warren

Chief Retail Officer

UFCU

Sam Poole

Chief Retail Officer

Chesapeake Bank

Randy Bresee

VP of Member Experience

Rivermark Community Credit Union

Malori Schlosser

Director, Retail Operations

WECU

Connect, Inspire, Thrive

Break the ice, talk strategies and create connections in our interactive learning formats.

Your Most Important Meeting of the Year

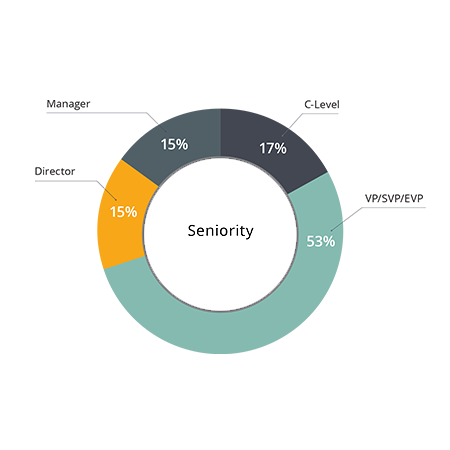

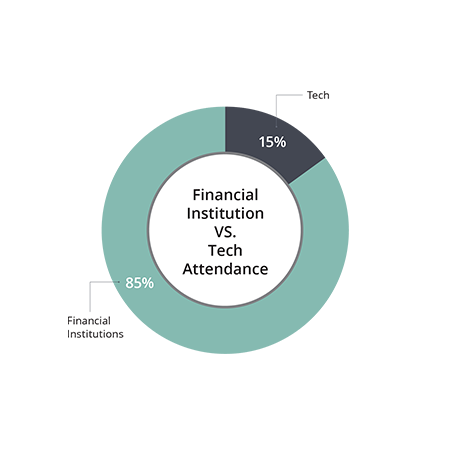

Future Branches is the ONLY event gathering an audience of senior retail banking executives looking for the next breakthrough technology to take them into the next year and beyond. Our attendees represent all aspects of financial services in America, from large banking institutions to community credit unions.

Spot on Content

“The content was spot on – we joined in on so many sessions encompassing all facets of our branch strategy. No other event addresses these critical issues like Future Branches does.”

Tammy Phelps

Vice President Operations

Arbor Financial Credit Union

Fantastic Community

“I love the community that has developed at the Future Branches conferences- we are all struggling with similar critical decisions that need to be made now about the next five years of our networks.”

Charles Schembri

SVP, Retail Banking

Amalgamated Bank

Great Opportunities

“Wonderful opportunity to see, hear and understand how banks are adapting their branches based on the significant changes taking place in our industry.”

Dave Schwertfeger

Senior Director Channel Optimization

CIBC

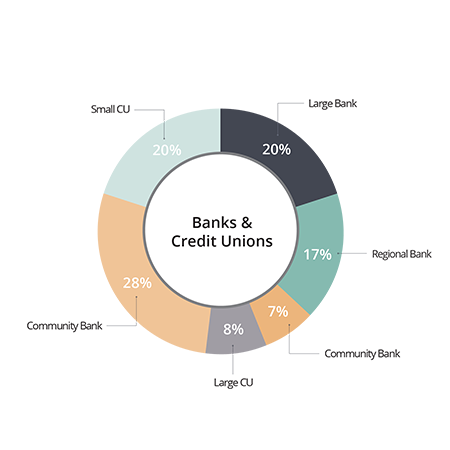

You’re in the Best Company

Future Branches brings together senior financial services professionals responsible for retail banking technology, experience, and strategy.

Learn From Those Leading The Way

We bring together an incredible group of executives from institutions of different sizes to speak to the challenges and successes they’ve had. Whether you oversee 1 branch or 5000, you will find a speaker from a similar sized institution on stage talking about the future of their network and sharing what has worked for them and even, what hasn’t!

Build Connections like Never Before

Benefit from tons of interactivity with over 15 hours of small discussion groups, creative think-tanks, roundtables, and structured networking activities every day. This is your opportunity to develop relationships, make new contacts and speak “off-the-record” with your peers.

Meet New Innovative Vendors All in One Place

The Future Branches Innovation Hub is THE place to find your next branch transformation partner. See the newest releases from trusted industry leaders and be wow-ed with revolutionary tech from up and coming players.

400+

Branch Innovators

250

Banks & CUs of all Sizes

15

Hours Intimate Networking

30+

Interactive sessions

Real Reviews From Real Attendees

See why the community rates Future Branches as the number one in-branch innovation event of its kind.

Come as an Attendee, Leave as

Part of a Community

You'll join 400+ branch transformation leaders over 3 days of insight, interaction, and innovation. You will develop relationships, make new contacts and experience an event unlike any other.

Fall in love with Austin

Austin Marriott Downtown

304 Cesar Chavez Street,

Austin, TX 78701

December 4 - 6, 2024

Website | +1 (512) 457-1111